A

trading execution model based on mean field games and optimal control

Lorella Fatone, Francesca Mariani, Maria Cristina Recchioni, Francesco

Zirilli

In [2] we present a trading execution model

that describes the behaviour of a big trader and of a

multitude of retail traders operating on the shares of a risky asset. The

retail traders are modeled as a population of “conservative'” investors

that: i)

behave in a similar way, ii) try to avoid abrupt changes in their

trading strategies, iii) want to limit the risk due to the fact of having open

positions on the asset shares, iv) in the long run want to have a given

position on the asset shares. The big trader wants to maximize the revenue

resulting from the action of buying or selling a (large) block of asset shares

in a given time interval. The behaviour of the retail

traders and of the big trader is modeled using respectively a mean field game

model and an optimal control problem. These models are coupled by the asset

share price dynamic equation. In particular this equation describes how the

asset shares price depends from the trading activity of the retail traders and

of the big trader. The trading execution strategy adopted by the retail traders

is obtained solving the mean field game model. The knowledge of this strategy

is necessary to formulate the optimal control problem that determines the

strategy adopted by the big trader. The mathematical models considered are

solved using the dynamic programming principle. Under some hypotheses the

solution of the mean field game model is reduced to the solution of a

(constrained) two point boundary value problem for a system of six Riccati ordinary differential equations. The optimal

control problem associated to the big trader is a linear quadratic control

problem. Under some hypotheses an explicit formula for the optimal trading

execution strategy of the big trader is deduced. A numerical study of the

trading execution model proposed is presented. The trading execution strategies

obtained with the model developed in [2] and those obtained using alternative

models are compared. This comparison confirms the quality of the model

presented. A general reference to the

work of the authors and of their coauthors in mathematical finance is the

website: http://www.econ.univpm.it/recchioni/finance.

Keywords: mean field game; optimal control; trading

execution strategy.

Content

1. The model

2. The solution

3. Numerical experiments (animation 1, animation 2, animation 3, interactive application, app)

4. References

1.The model

In [2] we consider a market

where a big trader and a multitude of

retail traders operate on the shares of a risky asset.

The big trader want to

maximize the expected (total) revenue resulting from the action of selling a

(large) number of shares of the risky asset in a given time interval (liquidation

problem). The analysis developed to study the liquidation problem can be easily

extended to the study of the problem posed by the execution of a buying order.

The retail traders are

conservative investors that belong to a population of individuals that:

·

behave in a similar way,

·

try to avoid abrupt changes

in their trading strategies,

·

want to limit the risk due

to the fact of having open positions on the asset shares,

·

in the long run want to

have a given position on the asset shares.

The behaviour

of the big trader is modeled using an optimal control problem.

The behaviour

of the retail traders is modeled using a mean field game model [4]. This means

that the behaviour of the retail traders is studied

in the “mean field approximation”. The (time) dynamics of the

trading positions of the retail

traders is substituted with a “mean dynamics” that describes the behaviour of the trading position of a “mean retail

trader”. We recall that the mean field approximation has been introduced

in statistical mechanics to study systems of interacting particles and that has

been used in the social sciences to describe multitudes of “intelligent agents”.

The mathematical models

that describe the big trader and the retail traders are coupled through the

asset price dynamic equation.

The retail traders

model

Let:

·

R be the set of real numbers,

·

T1ÎR be a positive number that represents the time

horizon of the mean field game model that describes the retail traders. This

means that the model that describes

the retail traders is solved in the time interval [0,T1],

·

xt, tÎ[0,T1], be a real

stochastic process that represents the number of shares of the risky asset held

by the retail traders as a function of the time t, tÎ[0,T1]. The variable

xt is called trading

execution strategy or trading position of the retail traders at time t, tÎ[0,T1]. Recall that the variable xt, tÎ[0,T1], describes the retail traders in the mean

field approximation. Positive values of xt, tÎ[0,T1], mean that the retail traders have a long

position on the asset shares, negative values of xt, tÎ[0,T1], mean that the retail traders have a

short position on the asset shares,

·

![]() be a continuous function that represents the

trading rate of the retail traders,

be a continuous function that represents the

trading rate of the retail traders,

·

m(t,x), xÎR, tÎ[0,T1], be the probability density function of the random

variable xt, tÎ[0,T1],

·

σ

be a (non zero) real constant,

·

Wt, ![]() , be a standard Wiener process such

that W0=0 and dWt,

, be a standard Wiener process such

that W0=0 and dWt, ![]() , be its stochastic differential.

, be its stochastic differential.

We assume that the trading execution strategy

of the retail traders xt, tÎ[0,T1], is

solution of the following stochastic differential equation:

![]() (1)

(1)

with

initial condition:

![]() (2)

(2)

where ![]() is a known random variable whose

probability density function is denoted with m0(x), xÎR. The probability density function of xt is denoted by m(t,x), xÎR, tÎ[0,T1].

is a known random variable whose

probability density function is denoted with m0(x), xÎR. The probability density function of xt is denoted by m(t,x), xÎR, tÎ[0,T1].

Equation

(1) is the mean field equation that describes the “mean dynamics”

of the trading position of the “mean retail trader”.

Note that in (1) the function ![]() is not a known coefficient. The function

is not a known coefficient. The function ![]() is the control variable that must be

determined solving the mean field game model.

is the control variable that must be

determined solving the mean field game model.

Let E(![]() denote the expected value of

denote the expected value of ![]() ,

A1 be

the set of the square integrable processes on [0,T1]

, and λ, θ, a be parameters such that λ>0, θ≥0 and

aÎR.

,

A1 be

the set of the square integrable processes on [0,T1]

, and λ, θ, a be parameters such that λ>0, θ≥0 and

aÎR.

The retail traders adopt the trading execution

strategy whose rate ![]() =

=![]() t=

t=![]() (t,xt), tÎ[0,T1],

solves the following problem:

(t,xt), tÎ[0,T1],

solves the following problem:

![]()

![]() (3)

(3)

where:

![]() (4)

(4)

subject to

the constraints (1), (2).

The model

(3), (4), (1), (2) is the mean field game model used to describe the behaviour of the retail traders.

The big trader model and the asset share price

dynamic equation

Let:

·

T2ÎR be a positive number such that T2≤T1, T2 is the time horizon of the

liquidation problem. This means that the selling order must be executed in the

time interval [0,T2],

·

Y>0

be a positive integer that represents the number of asset shares that must be

sold in the time interval [0,T2],

·

β:[0,T2]

× R → R be a continuous function that

represents the trading rate of the big trader,

·

yt, tÎ[0,T2], be a real

function that represents the number of asset shares of the risky asset held by

the big trader as a function of the time t, tÎ[0,T2].

The variable yt, tÎ[0,T2], is called trading execution strategy of the big

trader.

The liquidation problem of the big trader

consists in determining how to execute the order of selling Y asset shares in

the time interval [0,T2] in order to maximize the expected (total)

revenue resulting from the sale.

We assume that yt, tÎ[0,T2], is solution of

the following differential equation:

![]() (5)

(5)

with

initial condition:

![]() = Y,

(6)

= Y,

(6)

and final

condition:

![]() (7)

(7)

The function βt= β(t,yt), tÎ[0,T2], is the control

variable of the control problem that defines the behaviour

of the big trader.

Note that the differential equation (5) is the

equation used in similar circumstances by Almgren

[1].

The asset price dynamic equation of the model

presented in [2] is a simple generalization of the asset share price dynamic

equation used by Almgren in [1].

Let:

·

![]() be a stochastic process that

represents the price of the asset share “in absence of trading”, we

assume that d

be a stochastic process that

represents the price of the asset share “in absence of trading”, we

assume that d![]() = εdBt,

= εdBt, ![]() [0,T2], where ε>0 is a real parameter

and Bt,

[0,T2], where ε>0 is a real parameter

and Bt, ![]() [0,T2], is a standard

Wiener process, such that B0=0 and dBt

is its stochastic differential. The Wiener processes Wt,

Zt and Bt,

[0,T2], is a standard

Wiener process, such that B0=0 and dBt

is its stochastic differential. The Wiener processes Wt,

Zt and Bt,

![]() [0,T2], are assumed to be independent.

[0,T2], are assumed to be independent.

·

![]()

![]() ζ2

be nonnegative

constants.

ζ2

be nonnegative

constants.

Let St be the asset share

price at time t, ![]() [0,T2], we assume that St,

[0,T2], we assume that St, ![]() [0,T2], is a real

stochastic process defined as follows:

[0,T2], is a real

stochastic process defined as follows:

St = ![]() +

+ ![]() Mt +

Mt + ![]() βt + ζ2(Y-yt), tÎ[0,T2],

(8)

βt + ζ2(Y-yt), tÎ[0,T2],

(8)![]()

![]() given,

(9)

given,

(9)

where Mt = E(α(t,xt)) = E(αt) = ![]() , t

, t![]() [0,T1], βt = β(t,yt), t

[0,T1], βt = β(t,yt), t![]() [0,T1], and we assume that

[0,T1], and we assume that ![]() is a positive random variable

concentrated in a point.

is a positive random variable

concentrated in a point.

Equation (9) is the asset price dynamics

equation.

Note that the

asset price dynamic equation (9) allows negative asset share prices. The same

is true for the asset share price dynamic equation used by Almgren

in [1].

Let A2 be the set of the square integrable processes on [0,T2]. The problem of finding the optimal

trading execution strategy for the big trader consists in solving the following

optimal control problem:

![]() (10)

(10)

where:

V(β) = ![]() , β

, β![]() A2,

(11)

A2,

(11)

subject to

the constraints (5), (6), (7).

The problem (10),

(11), (5), (6), (7), (8), (9) is a linear quadratic optimal control

problem. The function V(β),

β![]() A2 is the expected final revenue resulting

from the liquidation order when the trading execution strategy yt, tÎ[0,T2], determined by β through (5), (6), (7) is adopted.

A2 is the expected final revenue resulting

from the liquidation order when the trading execution strategy yt, tÎ[0,T2], determined by β through (5), (6), (7) is adopted.

2.The solution of the

model

Let N(∙,+)

be the normal probability distribution of mean ∙ and standard deviation +

and let ξ be a random

variable. The notation ξ![]() N(∙,+) means that ξ is a

normal random variable distributed

N(∙,+). Using the ideas of Kalman [3]

under some hypotheses we reduce the solution of the mean field game model (3),

(4), (1), (2) and of the optimal control problem (10), (11), (5), (6), (7),

(8), (9) to the solution of two systems of Riccati

ordinary differential equations (see [2] for more details).

N(∙,+) means that ξ is a

normal random variable distributed

N(∙,+). Using the ideas of Kalman [3]

under some hypotheses we reduce the solution of the mean field game model (3),

(4), (1), (2) and of the optimal control problem (10), (11), (5), (6), (7),

(8), (9) to the solution of two systems of Riccati

ordinary differential equations (see [2] for more details).

In particular in [2] under the hypotheses that: there

exist μ0,

ψ0![]() , ψ0>0, such that

, ψ0>0, such that ![]() N(μ0, ψ0)

we show that

N(μ0, ψ0)

we show that ![]() N(μt,

ψt), tÎ[0,T1], where

N(μt,

ψt), tÎ[0,T1], where ![]() , tÎ[0,T1],

is the solution of the mean field game model (4), (3), (2), (1) and μt, ψt,

tÎ[0,T1], are determined from the

solution of a system of six Riccati ordinary

differential equations.

, tÎ[0,T1],

is the solution of the mean field game model (4), (3), (2), (1) and μt, ψt,

tÎ[0,T1], are determined from the

solution of a system of six Riccati ordinary

differential equations.

Moreover

in [2] when ![]() tÎ[0,T1],

we derive explicit

formulae for Mt, μt, t

tÎ[0,T1],

we derive explicit

formulae for Mt, μt, t![]() [0,T1], these formulae

are substituted in the asset share price dynamic equation (8) in

order to solve the optimal control problem (10), (11), (5), (6), (7), (8), (9).

In [2] we show that the corresponding optimal trading execution strategy of the

big trader yt=

[0,T1], these formulae

are substituted in the asset share price dynamic equation (8) in

order to solve the optimal control problem (10), (11), (5), (6), (7), (8), (9).

In [2] we show that the corresponding optimal trading execution strategy of the

big trader yt=![]() , tÎ[0,T2], solution of the

problem (10), (11), (5), (6), (7), (8), (9) is the solution of the following

differential equation:

, tÎ[0,T2], solution of the

problem (10), (11), (5), (6), (7), (8), (9) is the solution of the following

differential equation:

![]() (12)

(12)

with

initial condition:

![]() (13)

(13)

Recall

that since the formulae for Mt, μt,

tÎ[0,T2], deduced in [2] have been

obtained under the assumption ![]() N(μ0, ψ0)

also the formula for

N(μ0, ψ0)

also the formula for ![]() t

t![]() [0,T2], deduced in [2]

from (12), (13) holds under the assumption

[0,T2], deduced in [2]

from (12), (13) holds under the assumption ![]() N(μ0, ψ0).

N(μ0, ψ0).

3. Numerical experiments

Let us study the trading execution model

presented in Sections 1 and 2 via numerical simulation. In particular we consider

a liquidation order and in a test case we compare the value of the expected

total revenue of the big trader (11) associated to the optimal trading

execution strategy (12), (13) that we have found as solution of our model with

the expected total revenue of two alternative trading execution strategies.

We assume that:

·

the

number of asset shares held by the big trader at time t=0 is Y=2,

·

the

final time within which the sale must be completed is T2=0.6,

·

the

remaining parameters of the models of Section 1 and 2 have the following

values: T1=1, ![]() =10,

=10, ![]() =1, ζ2=0, λ=0.5, σ=0.8, μ0=10,

ψ0=0.5 and a=-50, θ=1.

=1, ζ2=0, λ=0.5, σ=0.8, μ0=10,

ψ0=0.5 and a=-50, θ=1.

Note that the choice:

·

μ0=10

implies that the retail traders are buyers at time t=0,

·

a=-50

implies that the retail traders are sellers at time T1.

With the

previous choices the optimal trading execution strategy of the big trader

determined by our model from being a concave function of t when t is close to

zero becomes a convex function of t when t is close to T2.

To fix the ideas we consider three trading

execution strategies (Strategy 1, Strategy 2, Strategy 3) that are shown in the

three animations that follow.

1.

In

animation 1 we show the optimal trading execution strategy of the big trader yt=![]() , tÎ[0,T2],

obtained as solution of the model presented in Sections 1 and 2 defined by

(12), (13) and in [2]. This is Strategy 1.

, tÎ[0,T2],

obtained as solution of the model presented in Sections 1 and 2 defined by

(12), (13) and in [2]. This is Strategy 1.

2.

In

animation 2 we show the trading execution strategy of the big trader defined as

follows:

![]() (14)

(14)

where ![]() , tÎ[0,T2],

is the optimal trading execution strategy shown in animation 1. This is

Strategy 2.

, tÎ[0,T2],

is the optimal trading execution strategy shown in animation 1. This is

Strategy 2.

3.

In

animation 3 we show the

optimal trading execution strategy of the big trader found in the “same

circumstances” using Almgren’s model [1]

that consists in selling with constant rate in the time interval [0,T2],

that is:

![]() (15)

(15)

This is Strategy

3.

Note that

Strategy 1 (see animation 1) makes use of

short selling (i.e.: yt becomes

negative for some values of tÎ[0,T2]). Strategy 2 and Strategy 3 do not use short selling.

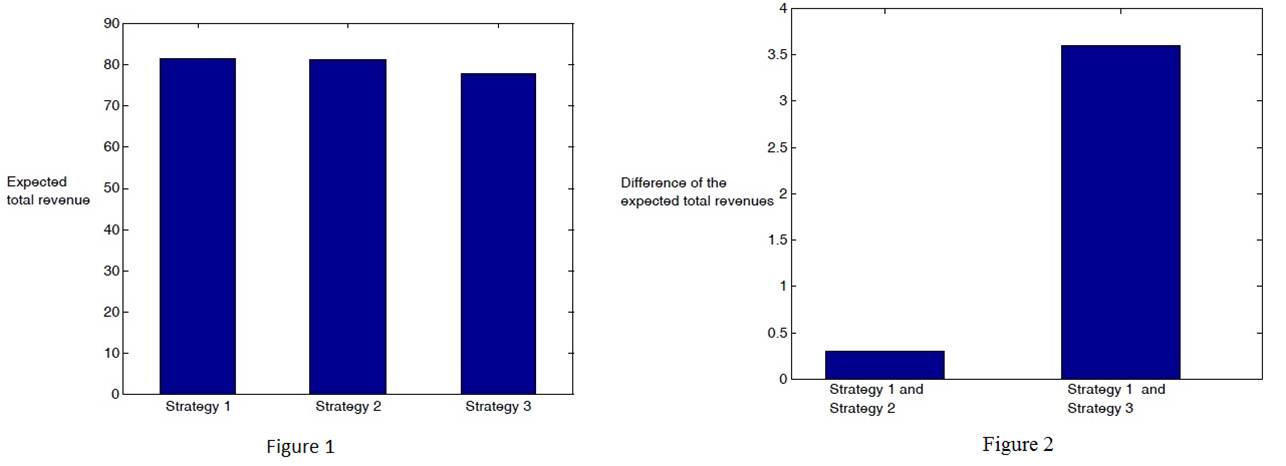

In Figure 1 we compare the values of the

expected total revenue (11) associated to the trading execution Strategies 1,

2, 3. As it should be the expected total revenue associated to the optimal trading

execution strategy, Strategy 1, is greater than the expected total revenues

associated to Strategy 2 and Strategy 3.

In Figure 2 we show the difference between the

expected total revenues associated to Strategy 1 and Strategy 2 and the

difference between the expected total revenues associated to Strategy 1 and

Strategy 3.

Finally an interactive application and an app

are presented. The interactive application computes and draws on a graph the

optimal trading execution strategy of the big trader, the mean value of the

trading execution strategy of the retail traders and the asset price dynamics.

In the interactive application the user must assign the values of some of the model

parameters. To facilitate the use of the interactive

application a set of default values of these parameters is given. The

remaining parameters of the models involved in the numerical simulation are

chosen as follows: ![]() =10,

=10, ![]() =1, ζ2=0, λ=0.5, σ=0.8, ψ0=0.5

and θ=1. Recall that the random variable

=1, ζ2=0, λ=0.5, σ=0.8, ψ0=0.5

and θ=1. Recall that the random variable ![]() that appears in (9) is chosen to be a

random variable concentrated in the point

that appears in (9) is chosen to be a

random variable concentrated in the point ![]() (assigned by the user) with probability

one.

(assigned by the user) with probability

one.

The interactive application has

been transformed in an app. The app runs on devices

based on the Android software system including smart phones and tablets.

App

4. References

[1] R. Almgren (2003). Optimal execution with nonlinear impact functions and trading enhanced risk. Applied Mathematical Finance 10(1), 1-18.

[2] L. Fatone, F. Mariani, M.C. Recchioni, F. Zirilli (2014). A trading execution model based on

mean field games and optimal control. Applied

Mathematics 5(19), 3091-3116.

[3] R. E. Kalman

(1960). A new approach to linear filtering and prediction problems. Journal of Basic Engineering 82 (1),

35-45.

[4] J. M. Lasry,

P. L. Lions (2007). Mean field games. Japanese

Journal of Mathematics 2(1), 239-260.

[5] D. Revuz, M. Yor (1999). Continuous

Martingales and Brownian Motion. Springer-Verlag,

New York.

|

Entry n. |

1 |